FOR INVESTORS

Real estate-backed notes

At New Age Financial Invest LLC, we understand that today’s investors face a wide array of choices when it comes to growing and protecting their wealth. For those seeking alternatives to the volatility of the stock market or the modest returns of traditional investments such as CDs and IRAs, we offer a suite of professionally managed real estate fund tailored to meet varying levels of involvement and investment goals.

Our fund is designed to provide consistent, competitive returns, leveraging real estate-backed loans to deliver secure and predictable income streams. Whether you’re looking for monthly distributions, fixed returns, or opportunities in short-term commercial or bridge loans, New Age Financial Invest LLC fund offers a reliable way to diversify your portfolio while minimizing risk.

Why Invest in Our Funds?

-

Stable Returns: Our funds aim to deliver returns ranging from 7.75% to over 10.25% annually, depending on the fund.**

-

Real Estate Security: Investments are secured by tangible real estate assets with conservative loan-to-value (LTV) ratios.

-

No Surprises: Unlike other investment vehicles, our fund operates without capital calls or performance-driven distribution interruptions.

-

Hands-Free Management: With a seasoned team of experts managing your investment, you can enjoy peace of mind and predictable growth.

** The returns described herein are targeted returns only and are not guaranteed. There is no assurance that the Company will achieve these targets or that investors will receive any particular level of return. In addition, any prior successes or performance of the Company’s management should not be viewed as indicative of, or a guarantee of, future results.

The Notes we offer

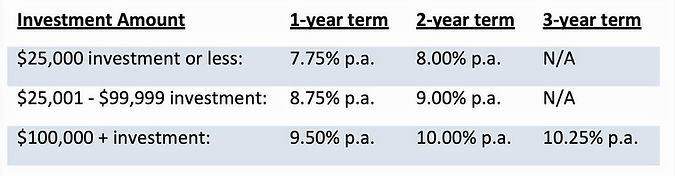

The Company is offering Notes with a maturity date of up to three years from the issuance date (the“Maturity Date”). If you invest less than $100,000.00 you may select a one-year or two- year term. If you invest$100,000.00 or more, you may select up to a three-year term.

Interest: The Notes will earn interest at the following rates being computed on the basis of a 360-day year and the actual number of days elapsed:

Participation in this offering is limited to investors who have completed third-party verification of accredited status, as required under Rule 506(c) of Regulation D.

For Individuals

You qualify as an accredited investor if you meet any one of the following:

-

You earned over $200,000 per year (or $300,000 with a spouse or spousal equivalent) in each of the last two years,

and you reasonably expect to earn the same or more this year.

-

You have a net worth over $1,000,000, either alone or with a spouse/spousal equivalent, excluding your primary residence (your main home).

Please read the Memorandum and The Agreement for more details. Please contact us with questions.

Regulation D 506(c) Mandated Legend

Any historical performance data represents past performance. Past performance does not guarantee future results; Current performance may be different than the performance data presented; The Company is not required by law to follow any standard methodology when calculating and representing performance data; The performance of the Company may not be directly comparable to the performance of other private or registered funds or companies; The securities are being offered in reliance on an exemption from the registration requirements, and therefore are not required to comply with certain specific disclosure requirements; The Securities and Exchange Commission has not passed upon the merits of or approved the securities, the terms of the offering, or the accuracy of the materials.